Table of Contents

It has become clear at car dealerships across the country that the market for new cars has begun to cool. After half a decade of substantial gains, the demand for new vehicles is experiencing a bit of a slow down, which makes now a perfect time to sharpen your skills. In a contracting market, there are still those who make an out-sized income.

When the market slows, those who have surfed by with lackluster skills and work ethic fall by the wayside, while superstars continue to gain market share. If you can survive the dip, you will be one of the few when the good times come back around.

To illustrate this, consider the home builders in the Bay Area, where I live. In 2007 and 2008, the market for new homes cooled off tremendously, leading many home builders to quit and join other industries. The going was tough for a couple of years. The few companies that did stick around, continuing to evolve and find new avenues to make money, ended up with the entire market to themselves when things turned around.

I’ve sold Audi’s to many of these folk, and they all say the same thing: the key is surviving the dip.

Step One of Standing Out in a Cooling Market: Work the Portfolio

The lease penetration rate of dealerships across the country has skyrocketed in the last seven years. As the economy recovered from the “great recession,” many customers came back into the market for a new car in a shifting landscape. Manufacturers such as Audi and Volkswagen had changed their lease offerings to be much more incentivized at the same time as electric cars with substantial federal rebates started to hit the market in volume.

When confronted with this market, many customers decided to lease.

Now, as the market cools, there is a pipeline of guaranteed buyers lined up for the next three years. Even if we see a global recession hit with a 10-20% stock market pullback in the next year (anything could happen), these lease customers will still need to make a decision.

Your goal is to gain control of as much of the lease end portfolio as possible. Learn how every part of the lease end process works and become the expert at your store. Ask your management team for a list of 90-day lease maturities and begin to send them robust email templates.

Here is the basic workflow for working the lease end portfolio:

- Get in contact with customers 90-120 days before their lease end. Represent yourself honestly as the lease maturity manager, and offer to do a “pre-inspection” of their car to prepare them for their lease end. By getting in touch early, you minimize the chance of the customer walking into a different dealership first.

- When the customer arrives for their appointment, have an exciting product for them to check out while you inspect their car. Using the lease contract guidelines, make a note of the condition of their current vehicle. Have your used car manager estimate their lease end vehicle’s value and compare it to their payoff.

- While explaining to the customer the lease end process, offer some key swap deals that you have prepared. You will find that in a cooling market for new cars, the used car market will thrive. This means that valuations will be higher for the lease end cars, with strong potential for an equity situation. If you can, structure a deal with equity for their lease end as a trade in, and offer to swap them into a new model with no money at signing.

- If the customer isn’t ready to make the jump, make sure you still leave a good impression. Their lease end date forces their hand- they are going to need to do something in the next 90-120 days. Make sure you are the person they think of first!

Here are some email templates that I have successfully used for my lease end customers:

Dear CUSTOMER,My name is NAME and I will be your Lease End Manager for your current BRAND.As you move towards your lease end date I will be able to answer any questions you have.If you are interested in leasing a new car, buying out your current vehicle (or anything else) I will be your contact here.You may be eligible to get out of your current BRAND early. Are there any new cars that interest you? Let me know if so- I can get you quotes using our BRAND Loyalty program.Thanks!Sincerely,NAMEPHONE

Good Afternoon CUSTOMER!

My name is NAME, I am the lease return specialist here at BRAND. I will be your primary source of contact for your end of lease options. I noticed your lease will be maturing in the near future and I just wanted to see if you had any plans after your lease ends. I will probably be trying to call you in the next few days to get in touch!

1. Do you want to pick out a new car?2. Do you want to purchase your current vehicle?

3. Other questions?

Please let me know what you decide so I can make it a smooth and easy for you. I would love to chat on the phone about your options- give me a call!Lease Maturity Date: __________

Thanks,

NAME

PHONE

Hi CUSTOMER,Just wanted to send you a courtesy email to remind you of your lease maturing soon! Do you have any questions or concerns you would like for me to address about your lease before that day comes? Let me know.Your Lease End Manager,NAMEPHONE

Step Two of Standing Out in a Cooling Market: Learn to Sell Used

At many stores all across the country, new car salespeople look down on used car salespeople. Instead of learning how to sell used cars, they ignore the entire side of the business, often scared of the label.

This is madness. Used cars are a huge profit center for your dealership, and you can be earning a cut of that.

After making sure that it’s ok with your management, start offering new and used options to every customer. Just by letting your customers know that you can sell used cars, you increase your lifetime value to the customer. Although they may come in to buy a new car, in the future, they may be back in the market for a used car.

Often I’ve sold new cars to parents, and then used cars to their kids.

Walk your used car inventory every day. Learn the “comparable cars” to your new vehicle offerings. Used cars can provide a great negotiation tool if you know the stock. When a customer offers you ten thousand dollars off on a new vehicle, counter by showing them the one-year-old version of the car they are interested in. The pricing of the used car will justify your new car price.

Here is how that works:

SALES: So, what did you think of the new Q5? The vehicle that you liked is listed for $51500, with all the best features!

CUSTOMER:I love the car, but my budget is more around $42000. What can you do for me?

SALES: I’ve got two great options for you. I can sell you this new car for the KBB price of $48200 or I can show you this one year old loaner car with the same options that is priced at $42500. Which would you prefer?

This inventory knowledge will make you a superstar negotiator. You don’t need tricks to win negotiations; you need information and a clear and concise way of communicating!

Step Two Bonus: Side Hussle Used Cars with Turo

If you take my advice and become a used car superhero, you will soon notice a large number of cars your dealership starts wholesaling after they take cars in on trade.

These cars are taken in on trade and then turned around and sold wholesale to smaller dealers and sent to auctions.

If you can save up a few thousand dollars, I suggest you look into picking up some of these cars cash from your dealer. Then you can start building your own Turo fleet.

Turo is like Airbnb for cars. It was initially meant for people who don’t use their cars every day to rent them out when they weren’t using them. Now, entrepreneurs have begun to build out their fleets.

My advice? Shoot for 8 or 9-year-old Honda Fits and Toyota Prius. These cars depreciate slowly, are cheap to maintain, and are easy to rent.

If you are interested, sign up for Turo with my coupon code to get $25 (I get $25 too, thanks!)

Step Three of Standing Out in a Cooling Market: Live Within Your Means

Personal finance is hard for everyone, but it can be especially hard for car salespeople. The boom and bust cycle of this business leads droves of salespeople to alternate between living in luxury and poverty.

The problem is that humans are bad at planning. When the going is good, people live large, spending every penny on fancy things and expensive indulgences, rather than focusing on the essentials.

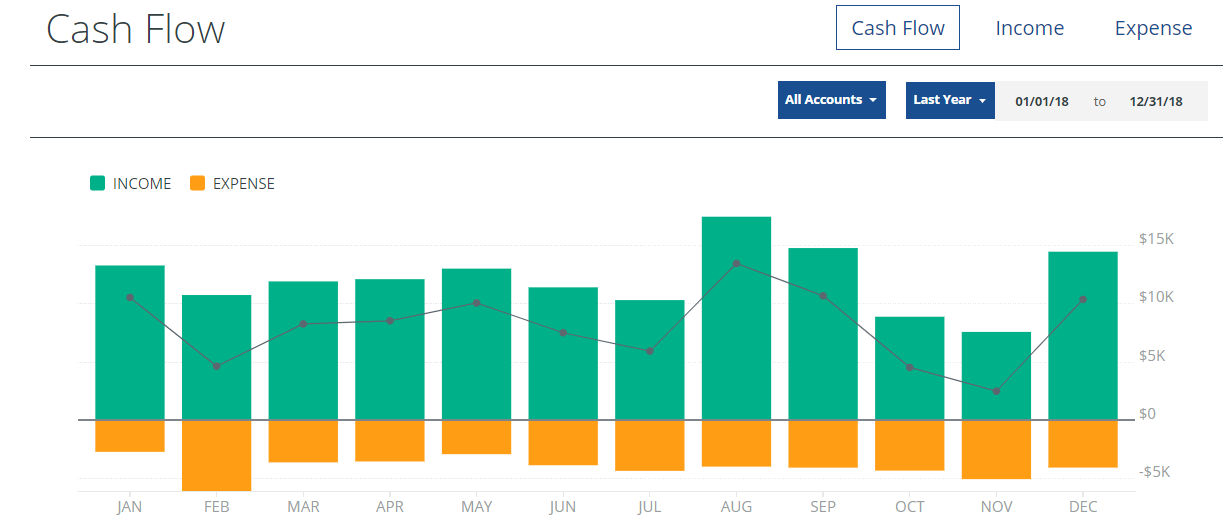

I track my income and expenses with Personal Capital (click for $20 coupon code). Here is what it looks like:

Using the app, I can track every income and expense, making sure that I am always keeping an eye on the big picture: growing my net worth. This is only possible when I carefully track my finances.

When the market cools, incomes tend to dip. If you are living beyond your means, you are in for a rude awakening.

Focus on lowering your fixed costs. Don’t rent the most beautiful house you can afford, or buy the biggest house that you can mortgage. Practice restraint on these enormous fixed costs, and you will be much more flexible in a downturn!

For a good idea of how I think about personal finance, check out Mr. Money Mustache.

Step Four of Standing Out in a Cooling Market: Double Down on You

Customers can buy a car from anywhere. If you are the salesperson, you need to stand out if you hope to survive the coming cooling market.

Salespeople get contented in their position at a dealership and begin to lag in their self-improvement. This is a trap!

My mentor Frank has a saying written up on the wall in the sales office: “Complacency is the Assassin of Ambition.” Don’t become the lazy salesperson who lets their skills dull in the bull market when the going is easy.

- Make sure you are keeping up to date with the newest vehicles and their options/technology

- Invest your time in building quality relationships with brokers (read chapter 10 and 11 in “How to Sell Cars on the Internet” for tips on this!)

- Join the forums over at DealerRefresh

Step Four Part 2: Personality

I’ve written extensively about car sales referrals, so I will just touch on this topic here.

Car sales is a business where in your personality can make or break your business. In this business, you are often going to be selling a product that is not unique to your store. This means that the customer has more options, and therefor you need to stand out more.

Your greatest asset in this business is your personality. Do you project confidence and trustworthiness? How often do you strive to find things in common with your customers? Do you listen attentively?

At the end of the bull market, you will find many salespeople who have grown lazy, content to be the same or worse than the day before. Make sure that you don’t fall into this trap. Make the extra effort to be the most likable salesperson possible.