Table of Contents

We are taught that money is a tool to pay rent, a tool to buy food, and a tool to save for retirement. We are also told that money is the root of evil, that money does not bring happiness, that money corrupts. All of this is true, in a sense. If that is the case, why should you run your life like a business?

Run Your Life Like a Business

The fundamental tenet of this article “Run Your Life Like a Business” is simple. If you ignore your money, your cash flow, and your investments, the money will likely become the greatest challenge of your life. If you concentrate on money just enough, you can eventually safely ignore it.

I need to get all of that out of the way before jumping into this article, my first personal finance article, on Car Sales Story. This article is not about car sales in any way; rather, it is about running your life as a business owner, with focus, direction, and the right tools.

My goal is for you to run your life like a business. I want you to be your own “life business owner.”

I’m also going to be introducing you to three tools* you can use to run your life like a business:

Let’s get started with the story of Ziggy, and then contrast the story of Zag.

*By the way, I’ll have a disclaimer at the bottom about the links to these tools!

The Story of Ziggy

Ziggy was a hard-working guy at ABC corporation. No one would call him a slouch. He clocked in on time and did everything that was asked of him.

Ziggy was a happy guy and had a full career. He worked for 40 long years at his dealership, getting small raises here and there for his hard work. He didn’t know how much others made, and he thought it would be rude ever to ask.

He loved getting his paycheck every two weeks because that paycheck paid for his rent, his food, and his bills. His money bought him excellent food at restaurants, where he loved to go.

If he had money left over at the end of the month, Ziggy would buy toys. He especially loved electronics and took pride in having the newest things that he found at Best Buy.

The Story of Zag

Zag, compared to Ziggy, was a pretty lazy guy.

He started work at ABC corporation about the same time as Ziggy.

Zag wasn’t quite as hardworking as Ziggy, but he had an eye for detail and a curiosity about money.

Zag asked a lot of questions at work. His curiosity about money was always there. If Zag got to know you well enough, he would ask how much you make. How much you spent. Why you spent on what you did. He was always trying to figure out who made the most money at ABC corporation. He tried to figure out why some people made more than others.

When Zag was paid, he had a budget laid out. He delighted in the magic-like power of the stock market. Zag, just a regular guy, working at ABC, could buy a little part of ABC with the money he didn’t spend. Zag loved the idea of his money-making money for him, mainly because Zag wasn’t a huge fan of working in the first place.

After a few years, Zag heard about Ted leaving. Zag knew (from all of his past questioning) that Ted’s job paid very well, and Zag had made sure to be next in line for the position.

Zag got the promotion, and he used the extra money to buy more stocks, and put money down on a rental property. Zag liked to think of his investments as an “Army of Dollars” that worked for him.

As he worked, the stocks and the rental property were growing in value, slowly, every day.

Zagging When Others Are Zigging

Ziggy, our first character, was missing one key element. He was approaching his work and his company with care and dedication, but he was all but ignoring his financial life.

He was a great employee, but his company had no interest in teaching him personal finance. His continued work was an asset, and hard-working employees are hard to find. What incentive did his company have to train Ziggy in personal finance? To teach him about money?

Zag, on the other hand, always had his financial position in mind. He understood that the company he worked for was indebted to the people that owned shares in the company, and he played the game as such. Zag wanted to be an owner, so he treated his finances like the very business he worked for.

Zag understood how his company was laid out, similar to how I recommend you use the Mega-Post to know how a dealership works if you work in the automotive industry!

Zag played the game. Ziggy did not.

Why Run Your Life Like a Business?

This article is, it must be said, was inspired by my time at the car dealership. I have sold thousands of cars, during which time I’ve had the opportunity to look inside the financial houses of my customers. I’ve come to understand how most of my customers think about money. I often am left feeling that there is a better way.

The business that I work for is publically traded. Every dollar in every vault and bank can be assigned an origin and understood in the context of the business. The dollars spent are categorized and accounted for. The dollars earnt are categorized and accounted for. Every single employee understands, to some degree, how the business is kept. They understand that money can’t go missing; it can’t disappear. People’s livelihood depends on this business being run with a keen eye.

When the business has profit, it is reinvested to make more profit. When a certain amount of capital is amassed, a new building is built, more inventory is bought, and more people are hired.

This same eye for detail and expansion can be the backbone of your finances. Every facet of your finances can, in the 21st century, be easily accounted for and tracked, for free. Not only that, if you can run a surplus, spending less than you earn, your money can quickly go to work for you. It has never been easier to run your life like a business.

The point is not money for money’s sake. The point is that if you don’t do this, you will end up having to think about money when it’s too late. When you want to retire, but the numbers “don’t make sense.” When your family member is sick, but there is no money for the health insurance deductible. When you lose your job, and you need some time to find a new one.

Money is your safety net. It is the lifeblood of your personal life business. Money is necessary and needs to be respected.

How To Run Your Life Like A Business

Your life’s business has the same levers as the business you work for, and the same things need to be tracked.

I’ll break down in this article how to understand the importance of your cash flow. I will show you how to track the money coming in and the money coming out.

I’ll also be jumping into the idea of capital, the backbone of your business. The proper use of wealth is the key differentiator between those who build a successful life’s business and those who don’t.

If your money doesn’t work for you, you will always need to work for your money.

Let’s Talk Cash Flow (Life and Business)

At my dealership, money comes in, and money goes out. At your household money comes in, and money goes out. How is it tracked?

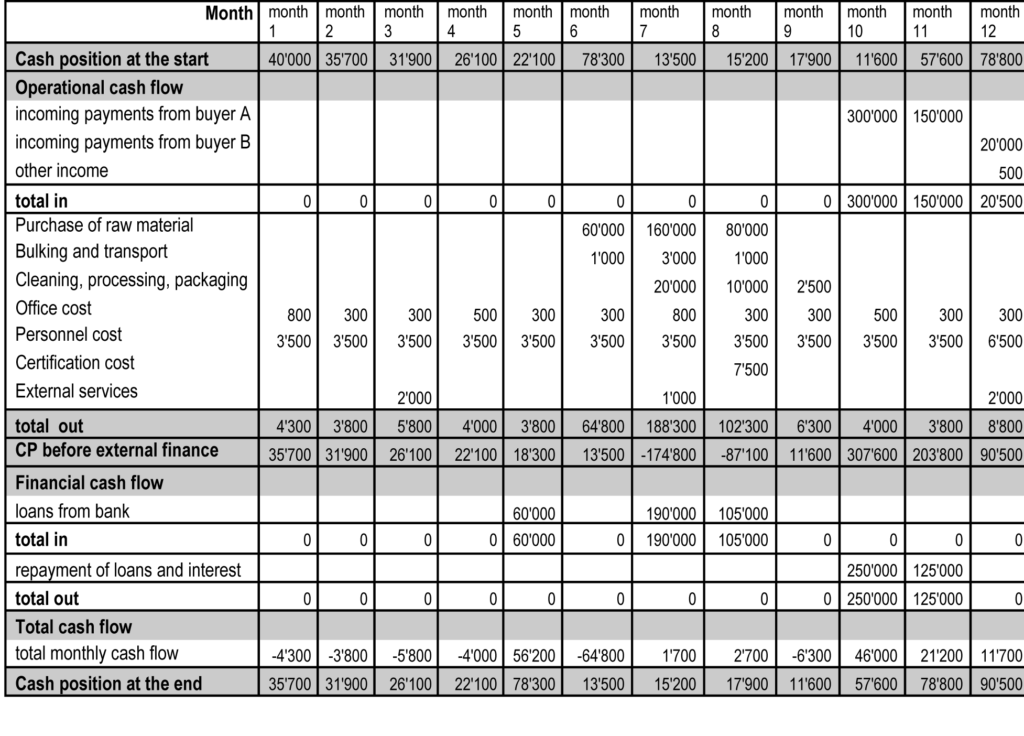

At the dealership, we have cash flow statements. These large, unwieldy documents, are the key focus of the General Manager, who needs to make sure that all of the store’s numerous commitments make sense. These documents also can reveal the profit centers of the business and reveal the places where the money is being lost. The General Manager looks at this statement every month, making sure that business is living up to its plan. Every facet of the business is revealed in this document.

financial statements are ugly

At your home, what do you use? Do you just check your bank statement? Your credit card bill? How do you know how much you are spending on restaurants every month?

Let’s try this; I’m going to ask you a few simple questions. You see if you know the answer off the top of your head:

- How much, exactly, do you spend on groceries every month? Is it consistent?

- How much, exactly, do you make (after tax withholdings)?

- What is your current net worth?

- How much do your cash flow, positive or negative, every month? Do you go deeper into debt? Or do you slowly grow your savings? Is it consistent?

How did you do?

Do you think that a General Manager of a dealership would know his business’s cash flow? Do you think that the business manager for your dentist knows how much profit the practice makes each month?

Now, if you knew all four numbers right off the top of your head, skip the next section (skip the “Cash Flowing” bit). There is plenty more to learn other than cash flow for how to run your life like a business.

If you didn’t, let’s talk about cash flow tracking.

Cash Flowing – Where Did My Money Go?

If you don’t know how to find out the answer to those questions in less than 5 minutes, it’s time to get some new tools.

The beauty is that just about all the financial tools these days are free, easy to use, and available on your smartphone.

You may be thinking that I want you to do this:

Old School

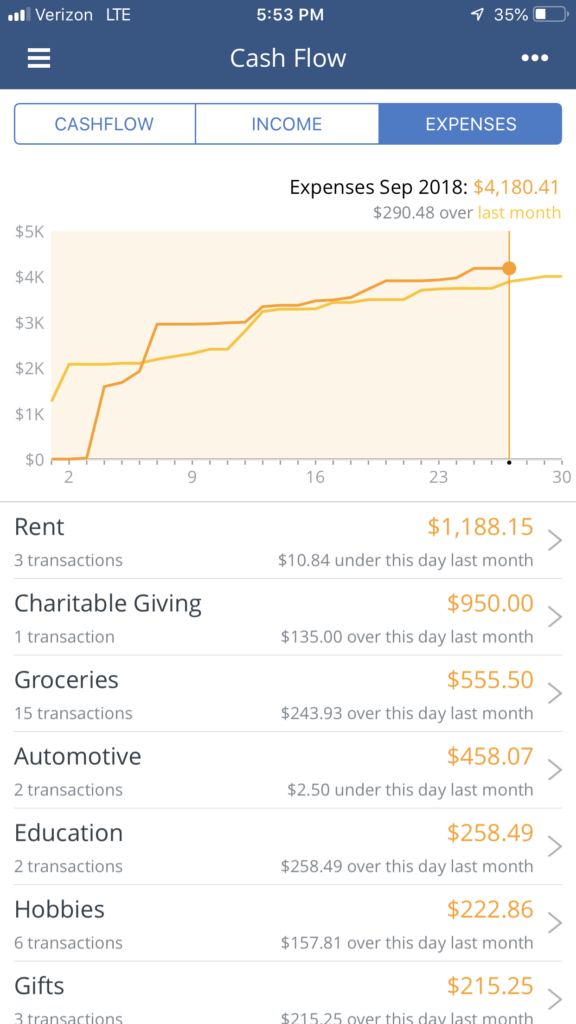

When in reality, I want you to use automated tools like this:

New School

Did I painstakingly label the transactions into those categories? No! The app, Personal Capital, did it all for me. All I did was link up my credit card to the phone application, and I was done. The computer went and categorized everything for me.

Personal Capital is our #1 tool for tracking cash flow, and I think it’s just about a requirement for you to use it if you aren’t following your cash flow right now. How are you going to get in control of your life’s business if you don’t know where your money is going?

Cash Flowing – How Much Am I Surplus?

The surplus will become your investment capital in the next section. How much do your cash flow every month?

Well, good news, Personal Capital can show you that as well!

I’ve mocked up this cash flow table in Personal Capital to demonstrate what this example high-earner would “cash flow” into surplus every month.

Cash Flow Table from Personal Capital (automated!)

According to this Cash Flow table, this person would have a surplus of $8500/month on average.

Now, this type of earning is not common, but I just mocked this up to give you an idea of what a cash flow table can look like. Even if your surplus $500/month, you can have an “Army of Dollars” that can grow to over a million dollars over your career (inflation-adjusted!).

Investing – Zag’s “Army Of Dollars”

If you can run a monthly surplus (your earning is higher than your spending), that money left over is your Capital. Capital is the only thing needed to make investments, and wealth is the main reason that the rich get richer.

When you think of “Investors,” your mind probably goes to Warren Buffett or Mark Cuban. You probably don’t think of yourself as an “Investor.” Why would you? What’s the benefit of being an Investor?

The benefit is simple. Your capital (surplus money) can be used to make more money. Your money can work for you.

The surplus dollars you save at the end of the month are recruits in your “Army of Dollars.”

This “Army of Dollars” goes to work every day at the same time you do, fighting the good fight, growing in strength day by day. This growth in your “Army of Dollars” is your “Return on Investment.”

How much should you hope that it grows per year? Well, the stock market is not guaranteed. It doesn’t always go up. When you run your life like a business, you don’t need guarantees. You need good chances.

Let’s Talk About The Stock Market

When I bring up the stock market, many people’s first response is fear.

I would invest in the stock market, but it’s really high right now.

or

I would invest in the stock market, but I don’t want it to go down in value, then I’ll lose my money. I like my cash.

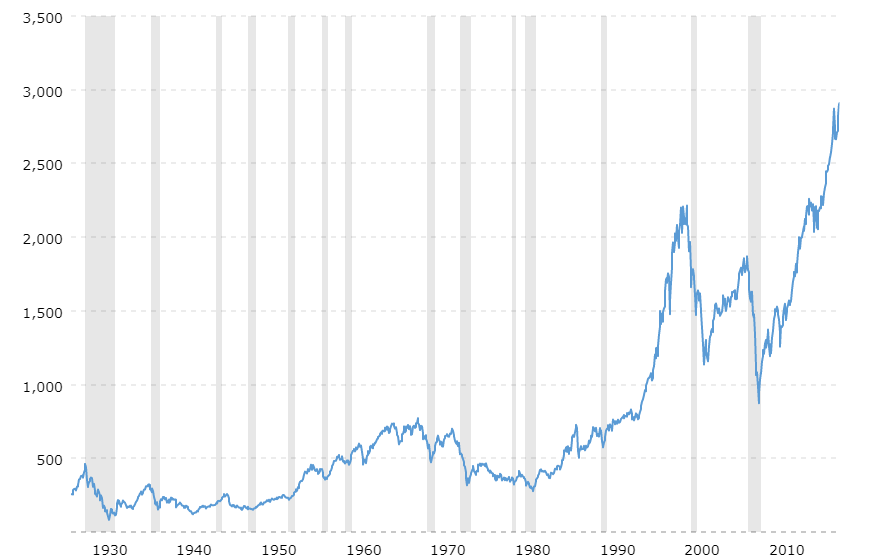

Fair points. What if you invest in the stock market and it goes down? It very well could. That being said, over time, it trends up, at the rate of about 10% per year. From there, you lose about 3% to inflation. That leaves you with an average of 7% gains per year. See below for the history of the stock market (already adjusted for inflation). You can see recessions highlighted in gray. Those were the periods when stock values trended down for a period. As you can see, over your lifetime, the system trends up.

S&P 1930-2018

Now, that money in the stock market will grow via compound interest, explained below by Investopedia:

One day, this “Army of Dollars” might grow large enough to support you!

A business owner looks at his or her business capital as a tool to make more money. Compound interest is a vital tool for how to run your life like a business.

The Difference Between Not-Investing And Investing

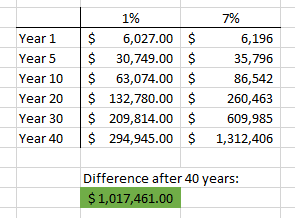

Using the 7% that I mentioned earlier, let’s create a table. We are going to compare two identical people, except for the distinction of being an Investor vs. Non-Investor.

They both have a monthly surplus of $500 to save. The Investor puts that money in the stock market and earns 7%. The Non-Investor takes that money and settles into a saving account, making 1%. Let’s see how this pans out over a 40-year career:

The Power of Compounding

The difference is over a million dollars. Inflation-adjusted.

Do you understand the power of your “Army of Dollars” now?

The “One Sentence” Investor

You, our new “life business owner,” know to understand the power of your “Army of Dollars.” You understand that investing is something you need to learn.

So do you need to do 1000 hours researching? No. If it were, I would have never have done it myself.

The fact of the matter is, in 2018, you can become an investor for free. If you have $500 in your bank, you can become an investor with this one-sentence instruction:

Download the application “Robinhood” on your smartphone, fund your account with $500, and buy the “SPY” index fund.

Done. Congratulations, you are now an investor.

Ok, you want a bit more information. Let me give it to you here:

In the United States (and much of the world), companies are owned by the public, represented by shares (a “share” of the business). When the company makes money and grows, it becomes worth more, and your shares grow in value. Robinhood is a “broker” who facilitates these transactions. Robinhood does not charge fees, which lowers the bar of entry on investing. You access “Robinhood” by using your smartphone or computer.

Now, the second part of my single sentence on investing involves buying “SPY”. What is that exactly? SPY represents the S&P 500, which is a combination of 500 of the largest companies in the United States. When you buy the SPY you are buying a little part of each of those 500 companies at the same time.

Instead of trying to “pick the right stock” you just buy a basket of the best ones. These have returned 7% (after inflation) over the last few decades.

If you want more info, Google has just about a billion articles about index investing. Time for you, our new business owner, to do some research.

The Magic and Awe of SPY

SPY is one of the greatest things in the world. When I buy a share of SPY, I am becoming a part-owner of 500 different businesses at the same time. I am buying a piece of Amazon, a part of Apple, a piece of Caterpillar, and a portion of The Clorox Company. At the same time!

When those companies make money, I make money!

Let’s get back to our business owner analogy that this article is based on.

When the business you work for has a surplus, it uses that capital to buy things to make more money. It buys the work of new employees; it buys the land to build a new building. These Investments make them more money. Investment is how the business grows.

Ziggy used his surplus to buy toys. He buys fancy cars, new watches, and clothes. His stuff makes him no money, but it makes him happy for a little while.

Zag used his surplus to buy SPY (and other investments). SPY goes to work every day for him, making him money. Zag knew how to run his life like a business.

The power of SPY and the S&P 500 is one of the best tools for how to run your life like a business.

Helping Ziggy Understand – Opportunity Cost

Ziggy loves his toys. How much have those toys cost him?

When Ziggy bought a brand new iPod in 2001, how much did that cost?

If you ask Ziggy, he would say $399+tax, because that is what he paid for it.

If you ask Zag, he would say just under $70,000. Why does Zag think like that?

Zag isn’t just thinking about how much it “cost” but about how much of an investment he could have bought with that money instead. If Ziggy had bought $399 of Apple stock instead of the iPod, today (9/27/2018) he would have $69500~. That means the iPod cost almost $70k.

This line of thinking is how a business person thinks. This is called “analyzing the opportunity cost”:

“Opportunity cost represents the benefits an individual, investor or business misses out on when choosing one alternative over another.”

You can think of all the toys with this same mentality. If you do, you will start to run your life like a business, instead of like a consumer. You are learning how to run your life like a business.

Want an easy, free tool to do these calculations? I’ve got one for you. Welcome to InvestedInstead. Beware- you may never look at consumption like Ziggy again!

The End Game: The Return of Humanity To The Equation

The best part about learning how to run your life like a business is a power that comes with your surplus. One of the best parts of my life is the charity that I can do with the money I make.

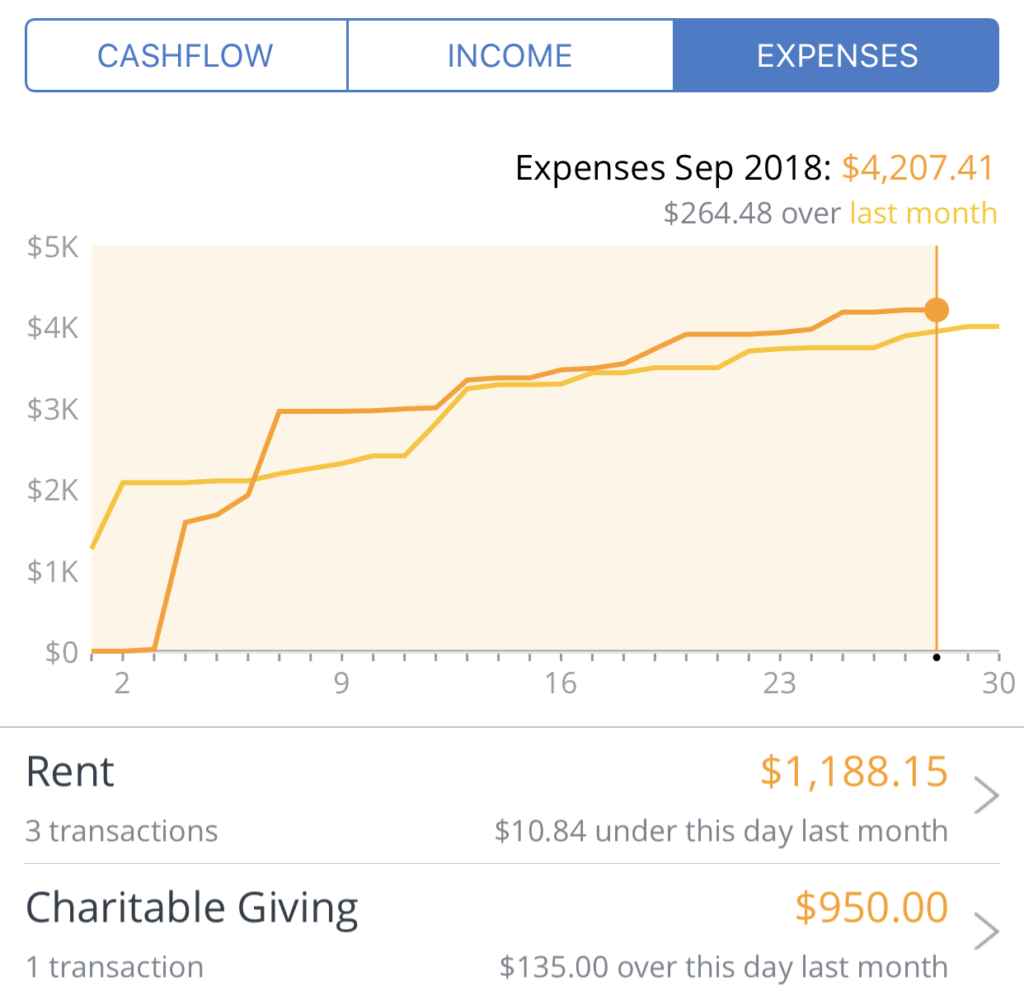

Retake a look at the expenses chart from earlier:

Rent vs. Charity

That decision right there, to have low rent** and to have a large amount of charitable giving, comes from an understanding of how to run your life like a business. This has taken years to get to, but I am happy with my progress. This article is about taking control of your financial life.

**Note: This low rent is in notoriously expensive Silicon Valley comes from my ability to understand the market.

Further Reading On How to Run Your Life Like A Business

Hopefully, you are now getting excited about learning how to run your life like a business. You are inspired to be like Zag, relentlessly pursuing career growth, and the ability to scale your life’s business at the same time.

Here are some the absolute best resources for you to continue this journey of learning:

- The Story Of The World’s Worst Market Timer: This short article will work to quell your fears about stock market investing by reviewing what would have happened if you invested all of your money on the days before the start of all recent recessions. Very interesting!

- Mr. Money Mustache: One of my favorite financial bloggers, has some very worthwhile articles:

- Investopedia: Annual S&P 500 Returns: Investopedia is one of the easiest reads available online regarding all facets of investing

Tools So You Can Run Your Life Like A Business (3x No-Brainers):

- Personal Capital: The easiest (free) way to track your money and your investments

- Robinhood: The easiest way to buy SPY, the name of the fund that tracks the S&P 500

- InvestedInstead: The easiest way to put your consumer purchases into perspective

Additional Tools to Run Your Life Like A Business:

- Vanguard: Vanguard gives you the ability to buy the S&P 500 and a wealth of other index funds at a small cost. More established than Robinhood.

- Compound Interest Calculator: Investment return is a crucial facet of how to run your life like a business. Remind yourself of its power here.

Disclaimer on Tool Links:

If you click on the links for Robinhood or Personal Capital, you will be taken to a signup page with an offer. For Robinhood, if you sign up using that link, we both get a share of a company, chosen at random by Robinhood. For Personal Capital, we both get $20, assuming you link an investment account (such as your new Robinhood account).

Since these are mutually beneficial, I figure it’s fair for me to include in this free article. If you want to skip them, feel free!

I think that these tools are great for how to run your life like a business, but there are alternatives out there.

As an older person reading this excellent article, I wish to say, had this information been so easy to obtain when I was in my 20s, I would be considerably richer today than I am today, BECAUSE I would have started earlier. I recommend these steps to everybody. I was never quite Ziggy, but it took a long time for me to get a bit of ZAG in my step. Step up now, while you are younger!

Great article Andrei! What Andrei describes here regarding the SP500 index is portfolio theory if anyone wants to inquiry more. Did you know that more than 50% of hedge fund managers cannot beat a simple SP500 index fund?