Table of Contents

Update, 6/18/20: There has been talking lately online about having pay plans tier off of percent closing. I think that this is a great way to avoid the problem of having BDC representative set appointments that have a low closing rate. The idea would be that in order to get the full commission per appointment the overall closing rate needs to hit a set figure.

For example, if a BDC representative’s appointment closing rate dipped below 20%, their per appointment commission would drop by 20%. If it dipped below 10%, then it would drop by an additional 20%.

Note that this type of structure does require active managing. If your entire store’s appointment closing rate is 15%, then the example above would only punish good representatives!

You can not afford to build an Automotive BDC that is unsustainable. The cost of hiring, training, and onboarding new representatives is incredibly high and needs to be avoided at all cost. You want your representatives to stay at your dealership for as long as possible. It is better for the culture and the bottom line.

It is critical for the success of your dealership that you implement a sustainable BDC pay plan.

If your BDC pay plan is unsustainable, you will have to shut it down during the slow parts of the automotive sales cycle.

Your BDC pay plan needs to scale with the volume of sales that your dealership generates, and it needs to be able to pivot during a downturn.

Today I am going to review three ways that you can make your BDC more sustainable. This article is a follow up to my thoughts on the recent article “4 Ways to Stand Out in a Cooling Market.”

Rely Heavily on Commission for the BDC Pay Plan

Having your dealership’s BDC pay plan rely heavily on commission allows your dealership to avoid manual pay cuts during downturns.

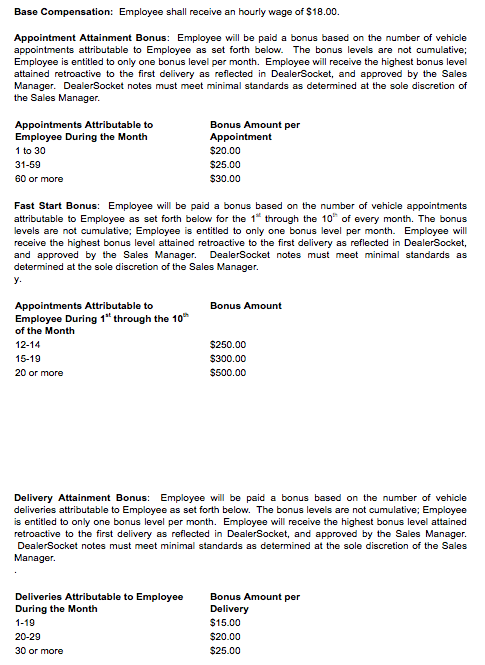

Here is an example pay plan from my dealership:

This pay plan is heavily weighted towards earning a commission since the vast majority of the compensation is locked in the BDC representative scheduling appointments that show and buy.

Even this pay plan would have benefited, in retrospect, with a slightly lower base hourly rate and marginally higher commissions. The less weighted towards hourly rate your BDC representatives are, the less financial burden they cause during the downturns.

Cycle the Lists

I recommend in the Automotive BDC Manifesto having your BDC representatives call the store’s fresh up customers (Chapter 3: Working the Floor Traffic). This way your dealership is less likely to lose deals when floor salespeople take their days off or forget to call their weekend drop-ins.

That said, there is an under-discussed danger involved with this plan: your salespeople can grow complacent, and begin to rely too much on the BDC.

If this happens, the net output of your dealership will decrease or stay the same, regardless of the efficiency of the BDC. In the worst case, the harder the BDC works, the less your floor salespeople will work, as they will recognize the “free labor” that the BDC offers.

How can you avoid this?

One way is to cycle the salespeople that your BDC representatives follow-up for. This will allow your sales managers to monitor the follow-up of your floor salespeople since the truth will be revealed when the BDC is not following up for them.

In a way, this is a way that you can keep your BDC pay plan sustainable since your BDC won’t make your salespeople lazy.

Search for New Opportunities

The BDC has a base pay, which differentiates them from most salespeople. Because of this base pay, they can be asked to follow-up with experimental customer groups that your sales team might not have had success with in the past.

An example experimental group may be service not sold customers. Many CRMs will be able to cross-reference your service appointment log with your sales CRM to provide you a list of customers that service at your dealership but did not initially buy from your store.

These are great potential future customers, but since this lead source will have a lower closing ratio, it can be challenging to motivate floor salespeople to pursue it. Since your BDC has a base pay, instructing them to follow up with these customers is a smaller pill to swallow.

Every market is different. The opportunity to explore new customer lists is a great part of having a BDC.

Bill the Deals

Your BDC’s work setting appointments should be thought of as an acquisition cost of selling cars. Most dealers have a “pack” that they bill every car deal that is meant to pay for the fixed costs of selling the vehicle (such as detail, marketing, and admin work).

To properly account for the cost of your BDC, it may be wise to bill your deals the average commission of your BDC representative (refer to your BDC pay plan for an idea of the average commissions).

The one thing you want to avoid is a confusion of incentives. Your goal is to sell cars, and for your team to successfully work together to accomplish that, you all need to appreciate each other. If you bill the deal too much, you can run the risk of salespeople resenting the BDC affecting their commissions.

That said, it is a worthwhile accounting strategy to consider. Protecting your BDC and keeping it financially sustainable is critical.

Your Thoughts?

What are some ways that you can make sure that your BDC doesn’t get cut during the next economic downturn? How can you build a sustainable BDC pay plan?